“The demands on city services and the need for investment in a wide range of areas exceed the capacity of property taxes to pay for them.”

You’d be forgiven for thinking this was a quote from Nicolás Maduro of Venezuela, but no, it’s about Toronto (although Maduro may well end up there as his chosen refuge — and he’d be welcomed by many).

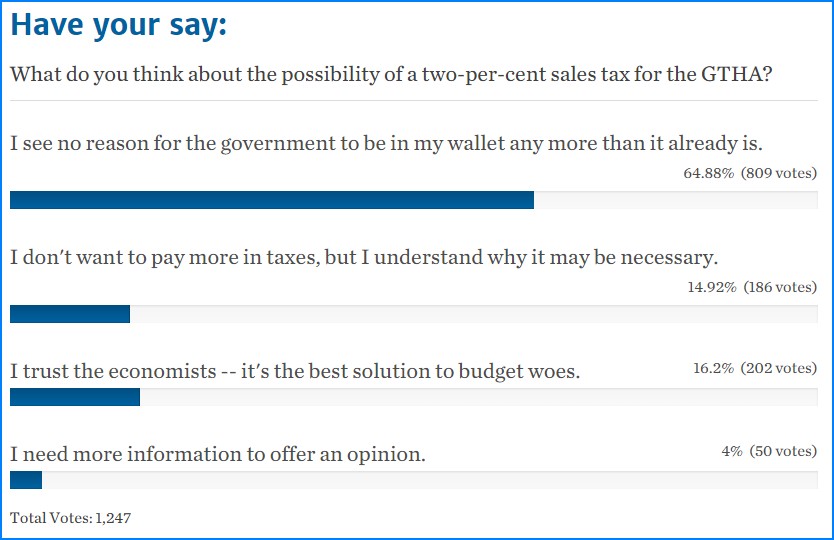

They don’t actually quote Maduro in this “news” story, but they do quote the Canadian Centre for Policy Alternatives. The “news report” is written-up today in their Toronto Star, complete with a reader poll (see below) which — at least up to now — is going very badly for Team Leftist. I love it when this happens.

The Star “reports” to us that the economists from the very Venezuelan Canadian Centre for Policy Alternatives (CCPA) advocates adding a two percent sales tax in Toronto in order to raise even more government cash. Note that it’s not raising taxes by “just” two percent — it’s adding another 2% onto the existing 13% harmonized sales tax. That’s raising sales taxes by 15.4%, just to be clear, which the Star most definitely made the editorial decision not to be (although if you read the full report by the CCPA, they do spell that out — they’re rather proud of their position!).

And it’s all utter ideological stupidity.

Let’s start at the beginning, by which I do not mean Karl Marx. Or maybe I do. The activists advocating this additional new tax is as I said, the CCPA, where, as I like to say, the “Policy Alternative” they speak of is socialism — as an “Alternative” to free markets, or as I like to call it, freedom. They should call themselves the Canadian Center for Socialism Advocacy. Or the Alexandria Ocasio-Cortez Party — AOCP.

So there’s that.

The life-improving plan from the CCPA is “…piggybacking one or two percentage points on top of the 13-per-cent harmonized sales tax…” in Toronto. But it also to give tax credits to those who are of “low income.” Depending on what we mean by “low income,” a huge percentage of people in this country pay practically no tax, whatsoever. The CCPA advocates for this redistribution of income and assets.

Even if taxpayers weren’t already overburdened, CCPA economics is badly flawed — no less so than the economics in Venezuela, which, in case you didn’t get the memo, hasn’t quite got the socialism right yet. (We are told this about every socialist or communist nation as they fail and their people die of starvation). Here’s one of the million — or I should say billion — ways they’re wrong:

“A two-per-cent sales tax in the city of Toronto would raise a billion dollars (a year) and a one-per-cent sales tax would raise half a billion dollars,” said study co-author Sheila Block.

Yeah, that’s wrong. Hugo Chavez wrong.

If one percent raises a half billion, and two percent raises a billion, where is the limit to this reasoning? Why stop there? If higher taxes raise an almost exactly proportionately higher revenue, then why not make it ten percent, and raise exactly five times the moolah?!

The reason is clear, at least among any non-socialist economist or, say, any random plumber or farmer or shop-keeper: raising taxes or costs of any kind actually produces a rapidly diminishing return, not an increase. This has been proven time and again, not only in all the failed socialist countries (still on track for a 100% global failure rate), but also in capitalist — or what I like to call free — countries.

The opposite is what works favorably. For more reading on this see the Laffer Curve theory, which always includes information such as this:

The theory later became a cornerstone of President Ronald Reagan’s economic policy, which resulted in one of the biggest tax cuts in history. During his time in office, tax revenues received by the government increased from $517 billion in 1980 to $909 billion in 1988.

Raising taxes has been shown to reduce revenues. Raising costs inhibits purchases, which is ostensibly why enormous “sin” taxes on alcohol and now pot, and cigarettes, and gasoline, and carbon, and a rapidly growing list of things, are invoked by governments. While tax cuts alone aren’t the solution to everything, this point is, and has been, proven over and over.

And taxpayers agree. But taxpayers shmaxpayers! Or as they say in luxurious Venezuelan government salons over shrimp cocktails while their citizens can’t buy toilet paper, “los contribuyentes van al infierno.”

The crack investigative team of journalists at the Star found not one single person on planet Earth who disagreed with any of this CCPA hooey. Quote after quote from the report authors, and from head-nodders, but not a single thought from anyone who disagrees. So everyone agrees, they would have you believe! Fake news much? Yes. Much.

But if, like the people of Toronto who voted in this poll, you thought the people of Toronto were reaching a breaking point in terms of the high-tax strategy that’s been growing, year after year, it’s lost on the socialist economist who co-authored the report. She says, and I quote, “The city of Toronto is reaching a breaking point in terms of a low-tax strategy.”

Holy outoftouch. But just in case you’re thinking of leaving to escape Venezronto. To wit:

Similarly, concerns about border issues—that businesses or consumers might go elsewhere to escape a sales tax—can be addressed as well. A city could set the rate at a low level and a regional sales tax would mean everyone buys in.

“Buys in.” By force. So nobody can “escape.” ¡Viva maduro y Venezuela!

- State-Funding of Sports Boondoggles Need To Be Sent To The Penalty Box - Wednesday March 13, 2024 at 4:44 pm

- I’m from the government and I’m here to help you become barely mediocre like us. - Tuesday March 5, 2024 at 11:53 am

- Big-Ass Government makes Big-Ass Blunder - Friday March 1, 2024 at 12:36 pm