Here’s a spiel from a study done by the Fraser Institute. Here’s the link to the whole study.

It’s not happy reading, but what do you think this is? “Sunny ways” days? (Here’s a bucket full ‘o good news to provide some relief.)

But at least we have the basics in Canada like a second-to-none military defensive capability with modern jets and basic equipment, clean drinking water on the indigenous reserves (and plenty of drinking water for our other citizens), and top-notch infrastructure throughout the country. And we’re taken super seriously internationally. And nobody interferes with our elections or anything.

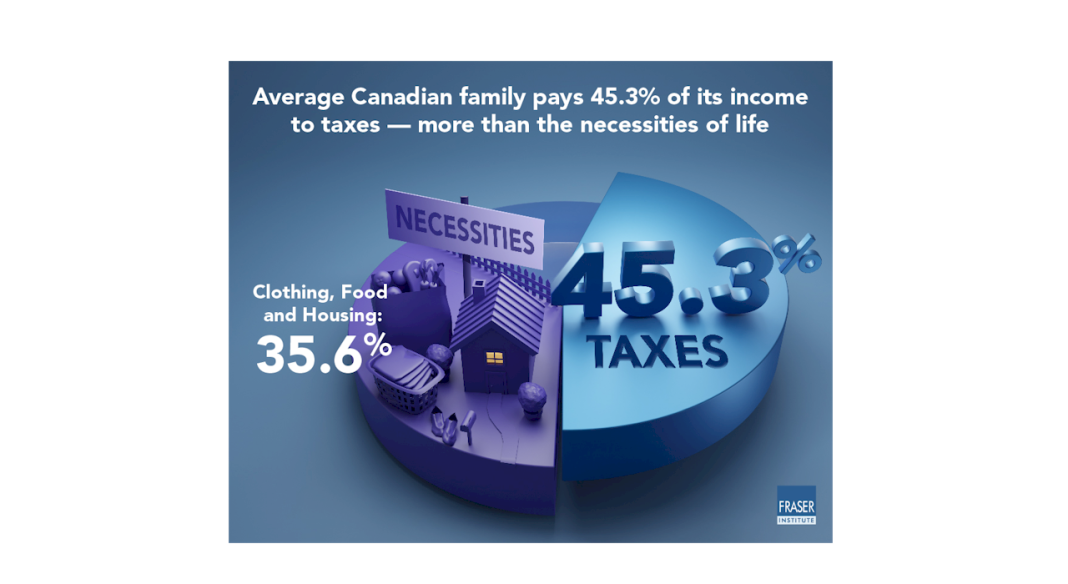

CALGARY — The average Canadian family spent 45.3 percent of its income on taxes in 2022—more than housing, food and clothing costs combined, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Taxes remain the largest household expense for families in Canada,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Taxes versus the Necessities of Life: The Canadian Consumer Tax Index 2023 Edition.

In 2022, the average Canadian family earned an income of $106,430 and paid in total taxes equaling $48,199.

In other words, the average Canadian family spent 45.3 percent of its income on taxes compared to 35.6 percent on basic necessities.

This is a dramatic shift since 1961 when the average Canadian family spent much less of its income on taxes (33.5 percent) than the basic necessities (56.5 percent). Taxes have grown much more rapidly than any other single expenditure for the average Canadian family.

The total tax bill for Canadians includes visible and hidden taxes (paid to the federal, provincial and local governments) including income, payroll, sales, property, carbon, health, fuel and alcohol taxes.

Moreover, since 1961, the average Canadian family’s total tax bill has increased nominally by 2,778 percent, dwarfing increases in annual housing costs (1,880 percent), clothing (654 percent) and food (870 percent).

“Considering the sheer amount of income that goes towards taxes in this country, Canadians may question whether or not we’re getting good value for our money,” Fuss said.

But there’s more! Because…PROGRESSIVE!

E.I. Premiums To Rise Again | Blacklock’s Reporter (blacklocks.ca)

- Progressives will control every single aspect of your life. Example 4,392: Montreal Bagels. - Thursday July 11, 2024 at 2:14 pm

- Bonnie Henry is a woke progressive loon. Fire her. - Thursday July 11, 2024 at 1:40 pm

- Halifax expanding their effort to help bring Canada down - Wednesday July 10, 2024 at 3:36 pm