The Trudeau Liberals (cue spooky music) say in their latest budget document (a 750-page behemoth nobody could possibly get through, which is entirely the point): “…we continue to have, by far, the lowest net debt-to-GDP balance relative to international peers.” Which makes average Canadians say, yeeeeahhh I’m not so sure I believe that. This skepticism is based on the solid foundation of the fact that the Trudeau Liberals are not trustworthy, and the government fails at just about everything they do, as a general matter. Conservative Canadians say yeeeeahhh, that’s total bullpoop (or sometimes, horse puckies).

Sure enough, as the far more trustworthy Fraser Institute, who does bother to read entire government tomes like the Trudeau/Freeland budget (cue spooky music), says today in a new report, “Deconstructing this argument is important to understand the actual state of Canada’s indebtedness, some of the complexities involved in international comparisons, and the risks of continued debt-financed spending moving forward.”

Their report tests the honesty of statements made by Justin Trudeau and the Liberals about the ever-so manageable level of our national debt. Trudeau and Finance Minister Chrystia Freeland say (and the media dutifully reports, word-for-word, unquestionably and uncritically), don’t worry, be happy, the budget will balance itself, we will tax the rich [background recording of YAY! is played for the state-owned CBC TV audience at home] evil corporations will pay their fair share! [background recording of YAY! is played louder], magic money fairies will decent upon Thunder Bay [or at least some Ontario or Quebec location] and distribute all manner of magic cash to Canadians from coast to coast to coast [background recording of YAY! is played]. Also remember to wash your hands, wear at least two masks even if you’re vaccinated, and STAY INDOORS! [background recording of YAY! is once again played, followed by a scary message from Dr. Tam.]

Here’s a smattering of info the Fraser Institute provided today:

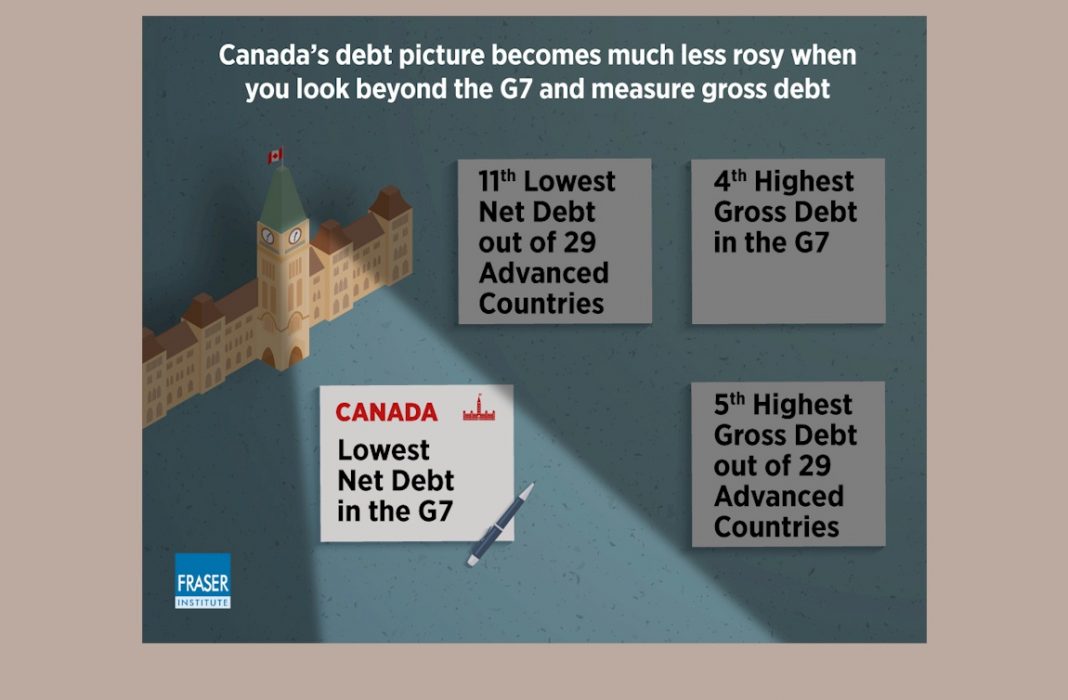

You may have noticed that the federal government has been very quick recently to point out that Canada’s net debt relative to the size of the economy is lowest in the G7.

But did you know that relative debt position is much worse than the federal government suggests when a larger group of advanced countries are included? And it gets even worse when total debt is measured instead of debt after adjusting for financial assets.

A new Fraser Institute study out today shows that Canada’s “lowest debt” rank falls from 1st to 11th when the group of comparison countries is expanded to the 29 advanced countries, and ranks 25th out of 29 countries for its total (gross) debt as a share of the economy.

In other words, Canada’s total debt relative to GDP is the 5th highest amongst the industrialized world.

Learn more about how the federal government distorts these numbers by checking out the full study here…

…Whereupon you’ll read:

Summary

-

- The federal government continues to rationalize its debt-financed spending based on international comparisons showing Canada with the lowest level of debt in the G7.

- Of the two broad measures of debt, gross debt includes most forms of debt while net debt is a narrower measure that accounts for financial assets held by governments.

- By using net debt as a share of the economy (GDP), Canada ranks 11th lowest of 29 countries and lowest amongst the G7. By using gross debt as a share of the economy, Canada falls to 25th of 29 countries and 4th in the G7.

- Canada experiences by far the largest change in its indebtedness ranking—falling 14 places—when the measure shifts from net debt to gross debt. Taiwan has the second largest change, an improvement of 7 positions.

- One reason for this pronounced change in ranking is that net debt includes the assets of the Canada and Quebec Pension Plans, which have unique approaches to funding public retirement plans: unlike most other industrialized countries, the CPP and QPP invest in non-government assets including equities and corporate bonds.

- As of March 31, 2020, according to Statistics Canada data, there were net assets in the combined CPP and QPP of $488.1 billion.

- According to IMF data, the difference between Canada’s gross and net debt was approximately $1.5 trillion as at the end of 2019, which means the assets of CPP and QPP explain roughly one-third of the difference.

The report shows that while the Liberals may be quoting one specific statistic which has some basis in truth (although it is a scant, and a rather selective, and a specious reading of the truth), they’re not telling the whole story, and the whole story is what you need and deserve. Not telling the whole story is another way of faking you out, which is something that only somebody who has no respect for you would do. Something that only a shyster would do to an unsuspecting sucker. They’re not being honest, nor transparent. How does that make you feel? And how will that make you vote?

(And yes, I do constantly bring these Fraser reports up, because they’re extremely valuable, and because the “news” media constantly fails to mention them, choosing instead to bring up whatever the Canadian Centre For Policy Alternatives is nattering about, which is usually something about how Canada should admire the basic dictatorship of Communist China, or at least ideas exactly like that.)

Once again, read the report. Here’s a link. Free information. Free truth. (Play happy music.)

- Proud To Be Canadian. But Maybe Not. - Tuesday December 17, 2024 at 2:07 pm

- Say something. - Friday October 25, 2024 at 6:03 pm

- Keep going, or veer right - Monday August 26, 2024 at 4:30 pm